The surprise winner of Biden’s controversial hydrogen bet

Geothermal energy missed out on the last big policy windfall, but it’s well timed to benefit from the long-awaited 45V tax credit for clean hydrogen.

On the Friday morning before Christmas, the Biden administration released its long-awaited rules for claiming some of the most lucrative tax credits in the Inflation Reduction Act, those earmarked for companies that produce hydrogen fuel with clean electricity.

Hydrogen, the most abundant element in the universe, can be burned like fossil fuels, but instead of planet-heating carbon dioxide the only byproduct is water.

Nearly all the hydrogen on the market today, used primarily fertilizer and petrochemicals, is made with natural gas in a process that leaves behind climate-changing pollution. But zapping water with enough electricity to separate the H from the H2O is another way to harvest hydrogen fuel. If the power comes from a zero-carbon source, the hydrogen is clean from end to end.

If the electricity powering the electrolyzer machines that make hydrogen from water comes from a dirty grid, however, the fuel is actually worse for the climate than its fossil-fueled alternative. That’s because it takes more energy to generate a kilogram of hydrogen with electricity than the molecule itself will contain, which is partly why “green” hydrogen costs as much as 12 times more today than the “gray” stuff made from methane gas.

The IRA has hundreds of millions of dollars in tax credits that could bring down the cost of green hydrogen by as much as $3 per kilogram, with the goal of bringing the price into the $1 range by the end of the decade. Any hope of meeting that “moonshot” rests on deploying a lot of electrolyzers – fast.

But giving out federal money to energy-hungry electrolyzers risks cannibalizing the grid’s clean electricity supply, creating more competition for clean power as demand is already surging for the first time in decades. To avoid this, the Biden administration is requiring that hydrogen producers who want to qualify for the full tax credit prove that new clean electric supplies entered onto the grid to offset the electrolyzers’ demand.

The rule, which senior administration officials unveiled to reporters on an embargoed call on Thursday, is set to draw fierce criticism from nuclear companies, whose reactors take too long to build for the atomic energy industry to be part of the hydrogen bonanza. That’s a problem, considering the president’s other big federal legislation, the Bipartisan Infrastructure Law, directed billions toward setting up either hydrogen hubs, three of which included nuclear as part of the mix. I wrote about this in my last newsletter after my trip to Oswego, New York.

The administration said it’s looking for carveouts for nuclear power. There are clear advantages to using fission to generate hydrogen. Nuclear is a 24-hour, carbon-free source of electricity, and electrolyzers should probably run as often as possible to generate as much hydrogen as cheaply as possible. And while, with one exception, the U.S. hasn’t constructed new reactors in a generation, there’s no grand buildout of new hydroelectric dams coming in a world where freshwater is growing scarcer.

There’s another 24/7 zero-carbon resource that’s just picking up steam, pun intended

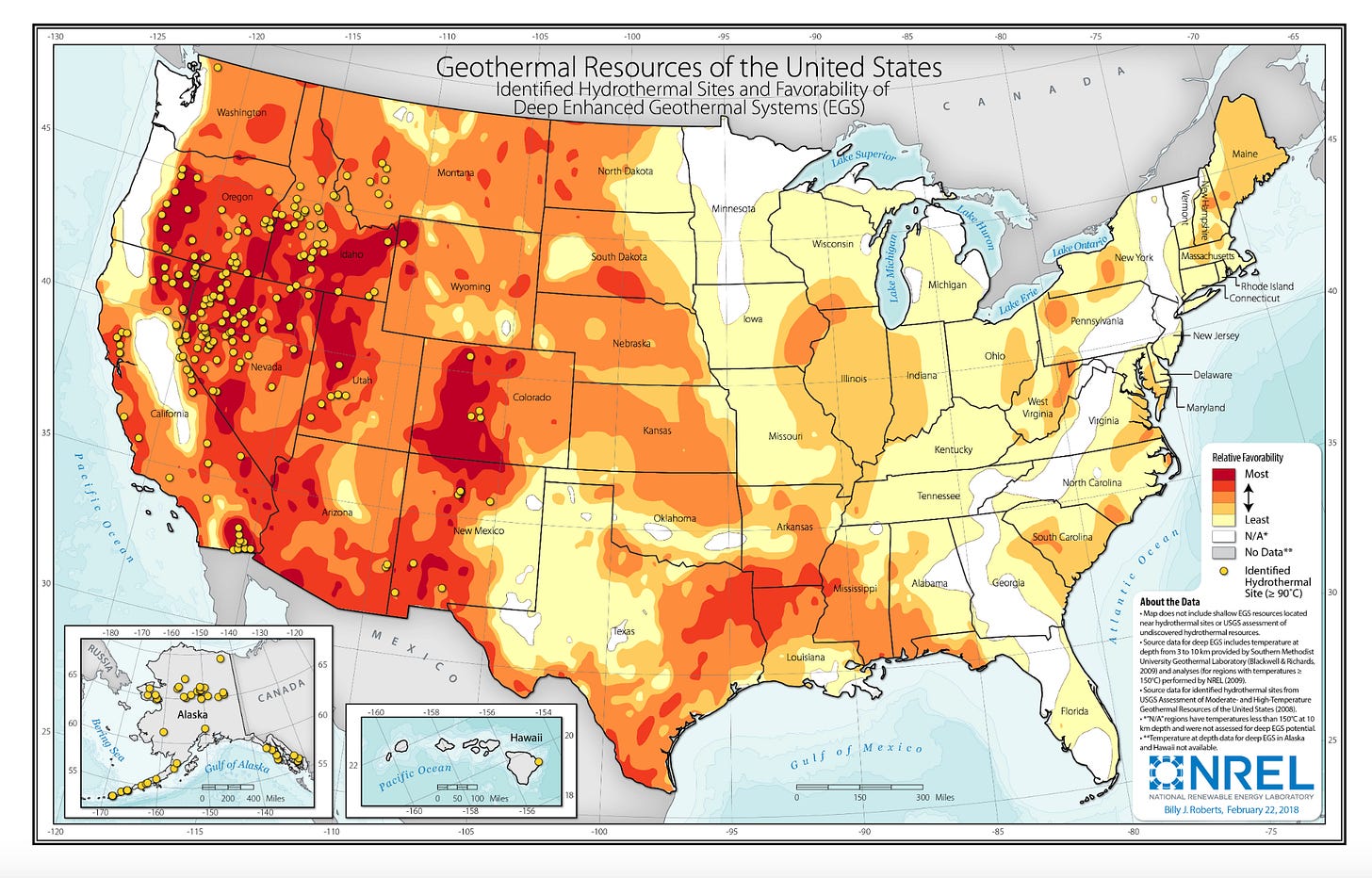

Geothermal power, which harnesses heat from the Earth’s core to generate steam for electricity, has long been limited to places with a thin upper crust or active volcanic vents like Iceland, El Salvador or Kenya. But “enhanced” geothermal, which uses drilling techniques pioneered by fracking companies to go deep enough to tap heat virtually anywhere, just underwent a major breakthrough.

Fervo Energy, the Houston-based company building the country’s first “next-generation” geothermal plant in Utah, expects to bring its first power stations online later this decade, right as the hydrogen tax credit is proposed to kick in fully.

For years, the timing has been off for geothermal. The industry’s technology advanced just after the U.S. passed its landmark climate-spending laws, funneling far less money to geothermal than to nuclear, carbon capture or wind. Now, however, the timing may be just right, Ben Serrurier, Fervo’s head of government affairs and policy, told me.

You can read the full story here on HuffPost.

Be a WHIMBY. Inside Climate News’ Dan Gearino has a great write-up of new research into what’s happening in my backyard. A new study examining the effect of wind farms on property values found that prices dip during construction but once turbines are in operation for five years, the gap with similar real estate further away closes.

Taking another spin. Offshore wind developers are looking ahead to new inflation-adjusted contracts propelling the sector out of its late 2023 doldrums. As part of her nice roundup of what’s ahead, Canary Media’s Maria Gallucci took a nice boat tour past the nation’s first-ever offshore wind farm off Block Island.

Russia’s nuclear node in Egypt. A new piece in the Bulletin of the Atomic Scientists explains how Russia is pursuing novel “build-own-operate” model at its El Dabaa plant in the North African country, where Moscow’s Rosatom covers nearly all the billions of dollars in construction costs in exchange for a repayment plan based on electricity revenues. Researcher Marina Lorenzini warns that the decision by Egypt’s leader to go ahead with this long-term relationship with Russia has “tethered his country, by many metrics, to an isolated regime and unprosperous country.”

Congress screws over uranium mining victims. U.S. lawmakers were set to extend federal benefits for miners, particularly those from Navajo Nation, who got cancer extracting uranium without proper safety gear during the nation’s midcentury nuclear-weapons buildout. But the amendment was stripped last week from the defense-spending bill, according to the Arizona Republic’s Arlyssa D. Becenti.

Japan, a threat to national security? In a public statement, White House economic adviser Lael Brainard said the Biden administration supports investigating whether a Japanese company’s $14 billion bid to buy U.S. Steel poses a threat to the future of a key domestic industry.

Happy holidays, and thank you for your time and attention. I hope this news update earned it. If not, maybe this music recommendation will. It’s a soulful, housey rendition of a Faith Evans classic called “No Other Love” by the Paris-based producer Chevals.

If you aren’t already a subscriber, please consider signing up or sending it to someone who might enjoy future updates. I’m proud of what an active list of readers has grown here over the past two years, and I’m especially flattered by how many of you have pledged money should I enact a paywall. I enjoy writing this newsletter and do my best to make it reflect what I like reading, which is, above all, writing that appreciates life’s complexity and tries to explain things accurately and simply. But it does take time on top of the reporting and writing I do for HuffPost.

I’m considering switching on optional paid subscriptions, with the plan to use what I make from there to subsidize this newsletter and justify keeping the majority of what I post here free for all readers. If this is something you’re uncomfortable with, or if you have ideas for how this kind of subscription model can create particular value for a reader, please reach out to me. You can reply directly to this email.

Keep an eye out tomorrow for a special newsletter on my recent trip to Mongolia.

Signing off from chilly Bay Ridge, Brooklyn, where New York City’s crackdown on illegal weed stores is officially underway.